Crypto Lender Celsius’ $800M Ether Staking Shake-Up Stretches Ethereum Validator Queue to 44 Days

Embattled crypto lender Celsius Network is shaking up its ether (ETH) staking strategy, congesting the already month-long queue to activate new validators on the Ethereum network.

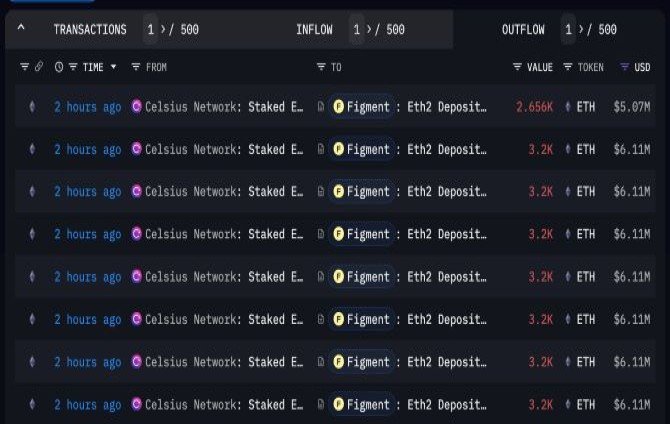

Over the course of two days, the firm has been diligently moving ETH into staking contracts after redeeming some $813 million of staked ETH from liquid staking leader Lido Finance. Since June 1, Celsius has deposited some $745 million in ETH, data from Arkham Intelligence shows.

The transfers have stretched the already long queue to establish new validators on the Ethereum network to 44 days, with Celsius potentially responsible for almost a week of extra time, Tom Wan, analyst at crypto investment product manager 21Shares noted.

The transactions are the latest development in the lender’s maneuver to reshuffle its staked ETH stash since Ethereum’s Shanghai upgrade enabled withdrawals from staking contracts in April. At that time, Celsius held some 460,000 ETH, now worth $870 million, staked with liquid staking platform Lido Finance and some 160,000 tokens, worth about $300 million at current prices, deployed in its own staking pool.

The transfers have occurred as the firm restructures after filing for bankruptcy protection in July, when it succumbed to liquidity issues due to plummeting cryptocurrency prices and a wave of user withdrawals. Last week, the U.S. bankruptcy court auctioned the lender to the winning bidder, Fahrenheit, an investment group backed by Arrington Capital that will assume the firm’s assets, including its institutional loan portfolio, staked cryptocurrencies, and crypto mining units.